Investing in the UK post-Brexit

How certainty around Brexit has lifted UK shares

In the weeks running up to the Brexit deadline at the end of last year, politicians kept the nation on tenterhooks, as several times it looked like they could not reach a deal.

But at the 11th hour, the negotiators, and leaders, reached a conclusion, which parliamentarians passed in a rush, and the nation breathed a sigh of relief.

Now we are almost a month into the new arrangements, how do the years of anguish over our relationship with Europe stack up?

While the fishing industry, and anyone who exports to Europe is finding the new reality outside the Customs Union and Single Market, a bureacratic maze, the markets have responded positively.

The big fear was a no-deal Brexit and the chaos that could have caused, as well as the almost complete unknown.

Now we have a deal, businesses can plan, and the markets have responded favourably.

What does that mean for investors? Is now a good time to get back into UK stocks, and particularly equities?

This report aims to answer some of those questions, and is worth an indicative 30 minutes' CPD.

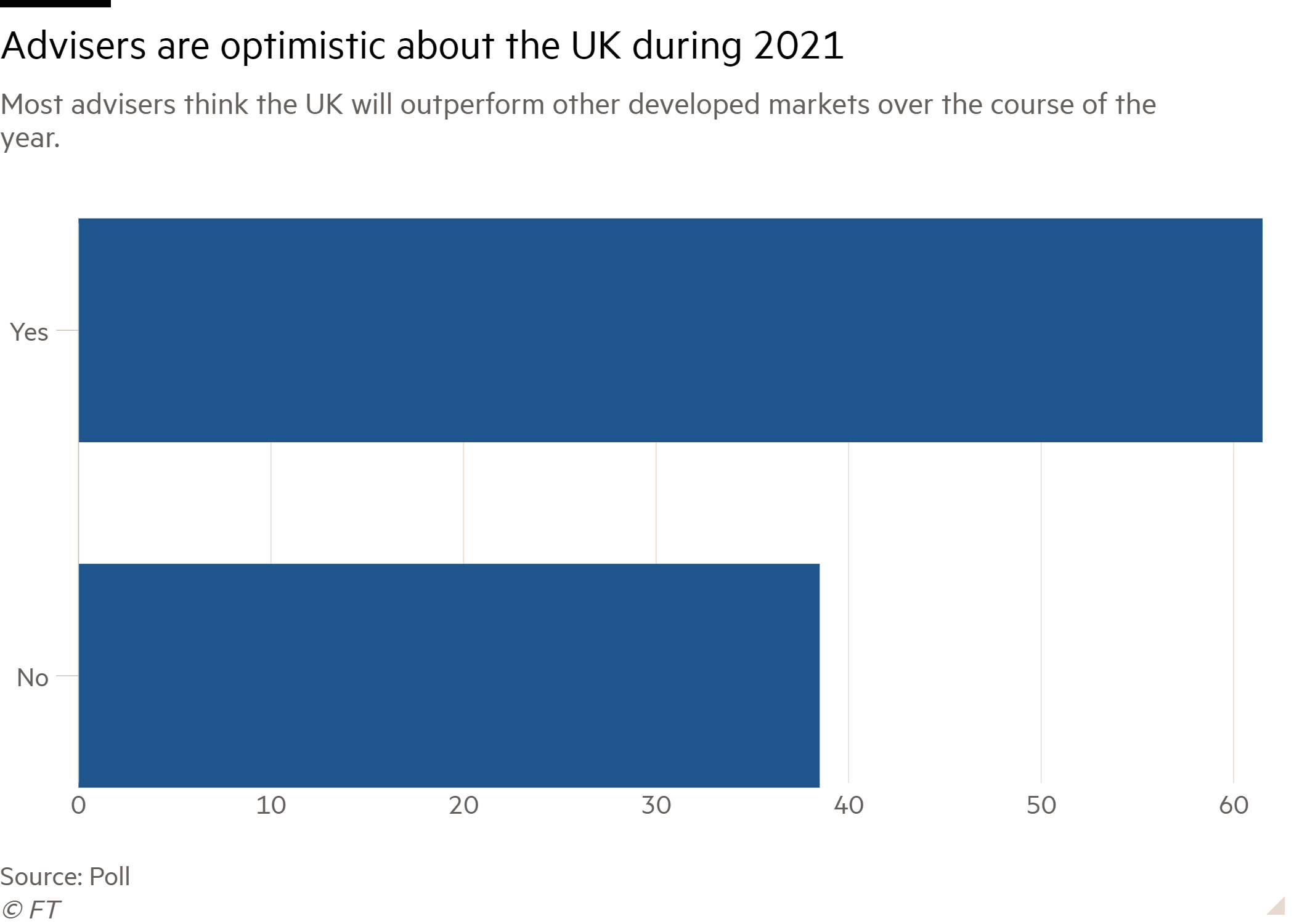

Advisers expect UK equities to perform better than most other equity markets in 2021, according to the latest FTAdviser poll.

The poll, which was conducted via Twitter, shows that over 60 per cent of advisers expect the domestic market to outperform this year, following years of underperformance.

A combination of: the political uncertainty which led to there being three general elections within four years; the uncertainty of the Brexit process, and the fact that many of the largest companies listed on the UK market are in sectors that the market perceives would lose out in a world of low growth; and low inflation, as many of those companies are in sectors such as mining, banking or oil, which perform best when economic growth is picking up.

Data from fund consultancy firm Square Mile Research indicates that the UK equity sector was the most viewed by users of its website in the final quarter of 2020.

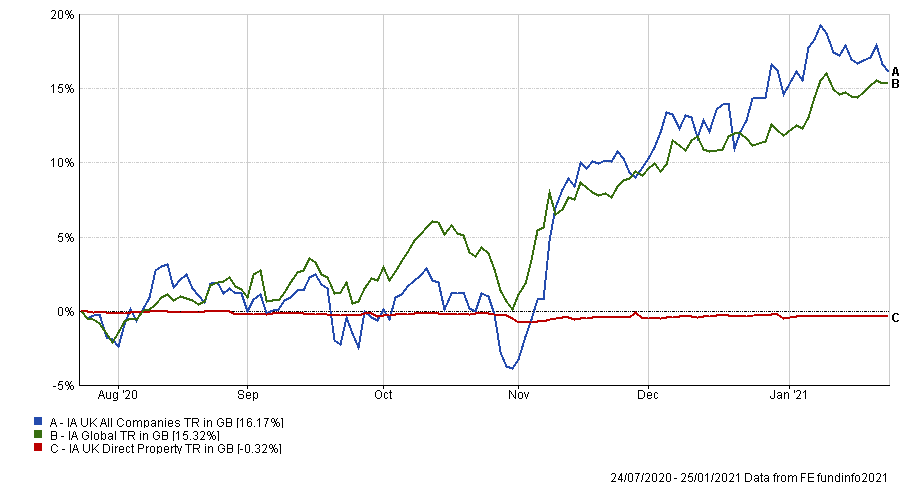

Q4 saw an extraordinary continuation of the rally that started in late March 2020.

Jack Glover, chief operating officer for research and consulting at Square Mile said: “Q3 may have ended with some mild profit-taking in equity markets, but Q4 saw an extraordinary continuation of the rally that started in late March 2020.

"Global equity markets rose in mid-teen percentages and the UK equity markets were no different. It is perhaps unsurprising that after a poor Q3, advisers looked to the UK equity market for ideas in Q4.

"That is not to say there was not an element of caution. The fact that the IA Mixed Investment 20 per cent-60 per cent shares sector was the second most viewed would suggest that advisers are seeking to build a buffer against any potential sell-offs.

"It is interesting to note that while many market commentators believe that inflation is due to make a comeback in 2021, inflation protection was the least researched investment outcome."

UK equities have bounced back since Brexit

Making a case for UK equities to perform well in 2021 is not that difficult, according to George Godber, who runs the £1.1bn UK Value Opportunities fund Polar Capital.

Mr Godber says: “In 2016 the UK equity market as a whole traded broadly at the same sort of valuation level as did other global equity markets, but since then has traded at well below the level of the other global developed markets.

“People make the very valid point that many of the biggest companies on the UK market are in sectors where there may be long-term structural issues, but even if you adjust for that, and weigh it by sector, the UK market is still trading at a discount.

“But what we have seen lately is heightened corporate interest in the UK, as overseas buyers look at UK companies. That is something which wasn’t there nine months ago, because the market had to wait to get certainty on Brexit, and that is there now.”

It is a thin deal, and it seems to have created a lot of grit in the system, but if there had been no deal, then that would have been a whole cement mixer

He adds: “The uncertainty around whether there would be a trade deal caused a lot of negatives to emerge in the market, so the fact there is a trade deal is a positive.

“It is a thin deal, and it seems to have created a lot of grit in the system, but if there had been no deal, then that would have been a whole cement mixer into the system.

“The fact that has been avoided means some bounce in the FTSE was justified.”

Simon Murphy, UK equity fund manager at Tyndall says: “The global economy is “displaying all the hallmarks of classic recovery” as we enter the new year with commodity prices rising and risk assets performing better.”

He added that the UK market bore the brunt of the slump due to the nature of the companies listed on the domestic market, and so can outperform the wider world.

Mr Murphy adds a uniquely domestic factor which negatively impacted share prices was political uncertainty in the UK, with three general elections happening within four years, and persistent uncertainty around the outcome of the Brexit negotiations.

With those uncertainties removed, the very factors which made the UK market underperform during the pandemic-induced market slump are now the factors which could lead to the market outperforming, namely the type of stocks which dominate the UK market, in economically sensitive areas such as oil, mining and banking.

Alexandra Jackson, UK equity fund manager at Rathbones says the Brexit issue “allowed global investors an easy reason to reduce their UK holdings when they were worried about structural issues anyway.

“But their UK weightings had fallen to such low levels that the announcement of a Brexit deal meant they increased their weightings quickly.

“I am quite cautious on the long-term outlook for many of those big cyclical companies in the FTSE 100, though, as the structural questions have not gone away. But I think where the opportunity is, is further down the market cap scale, and even on the AIM market.

“There are good business-to-business technology companies down there that are achieving growth and in many cases are superior to their US or global companies in the same sector, but the negativity around the UK has depressed the UK companies' valuations.

“The UK doesn’t have much in the way of consumer tech companies, but in areas like cyber security it has world leaders.”

Sam Dickens, portfolio manager at IG Group says the relatively strong performance of UK equities since the start of 2021 is likely to continue throughout the year because UK equities came into the year trading at much lower valuations than other markets; even with the rises since the start of the year, UK equities, in valuation terms, continue to trade at their cheapest level relative to other global markets since the global financial crisis.

A particular feature of the improved stock market performance since the start of the year has been the relatively stronger performance of the companies generating more of their income from within the UK, compared with the companies which generate the bulk of revenue from overseas.

This contrasts with the performance of the home market in the period between 2016 and 2020, when the value of sterling fell, and it was the overseas earners which benefited because the lower value of sterling relative to other currencies, increased the value of overseas earnings, while some exported goods may also have been made cheaper.

The advent of the Brexit agreement and the onset of greater global optimism around the pandemic means sterling has risen in value against the dollar this year.

The dollar is traditionally viewed as a safe haven asset in times of market strife, so as optimism became the dominant market emotion towards the end of 2020 and into 2021, the dollar weakened, reducing the relative value of overseas sales for UK companies.

Mr Dickens says that if sterling were to continue to rise relative to the dollar, this would likely hurt the returns for UK investors, due to the dominance in the FTSE 100 companies that derive the bulk of their earnings from abroad, so a prolonged rise in the pound would likely lead to a reduction in the value of those earnings, reducing the attractiveness of those companies.

Joachim Klement, an analyst at investment bank Liberum, says he believes sterling remains about 10 per cent undervalued against the Dollar and Euro.

He says: “We still think that Sterling is about 10 per cent too cheap vs the US Dollar and the Euro. With Brexit uncertainty removed, we can already see more and more foreign investors shifting their portfolios from US equities to cheaper UK and European equities.

“Furthermore, there is now a good time to invest directly in UK property and businesses. All of this should drive further appreciation of sterling.

We still think that Sterling is about 10 per cent too cheap vs the US Dollar and the Euro

“This in turn means that international earners in the UK stock market will face headwinds from a weaker US dollar and euro and should underperform domestic earners.”

World wide web

While the UK and global geo-political picture has improved, and probably moved the economy into a new cycle, the domestic market will continue to be buffeted by the forces creating profound change at the global level, according to Mr Godber.

He says the disruption to business models which has been accelerated by the impact of the pandemic means he is avoiding some of the stocks which he would typically buy at this stage of the market cycle.

Mr Godber says: “This is probably the first time that the UK market has been emerging from a crisis where we have not bought any of the property companies. At this stage one has to ask how much of the rent they will be able to collect, and how home working impacts them over the long-term.

“That is also true of the food on-the-go sector; there are five Pret-a-Manger shops very near our office, and you have to wonder: will that be viable as people work from home a bit more?”

Colin Morton, UK equity fund manager at Franklin Templeton, says that while the disruption means he will not buy all of the same stocks he might have done in past recoveries, he will not exclude any sector from consideration as he believes some companies are set up sufficiently well that they will gain market share.

On the cusp of change

Didier St Georges, managing director at French fund house Carmignac, says the world may be on the cusp of a change after “forty years.”

He says this change would involve increased government intervention to manage economies, rather than the situation he believes has prevailed over the past decades where much of the management of economies was effectively devolved to central banks.

Mr St Georges says the impact of the policy of devolving economic management to central banks has been that lots of extra money has been printed, but this money has not found its way into the real economy, and so not positively contributed to economic growth or inflation.

He believes this may change if central bank action is matched by governments, then growth and inflation could rise.

If this change happens, the likelihood is the UK market would perform relatively better than other global markets, as more of the sort of companies that benefit from higher global growth and inflation, such as oil companies and banks, are located within the UK market.

Those are the same sorts of stocks that have bounced as a result of the Brexit deal being agreed.

Saving Grace

Ian Lance, who recently took over the joint management of the Temple Bar Investment Trust and is another who believes that we may be on the cusp of a profound change in markets.

However, he believes the shift in markets in recent weeks owes more to the progress in the areas of vaccines than to political changes, but the outcome is the same: that those stocks which benefit most from higher GDP will rise more than those which have thrived in an environment of low growth and low inflation.

Mr Lance’s view is that the lockdowns have instigated a significant change in the outlook for the UK because they are creating a situation where many households are able to pay down debt, and increase savings. The impact of this, he feels is that when people are allowed to spend, they will do so freely, whereas for much of the past decade they have been constrained in their personal spending by debt levels.

He says: “Whilst some workers have been made redundant as a result of lockdown, many more have continued to work but have been spending less and hence saved more – the Bank of England estimates that the extent of this additional saving is in excess of £100bn. As lockdown ends, there is a possibility this pent-up spending will be unleashed, leading to a pickup in demand for consumer goods and services.

Many workers have continued to work but have been spending less and hence saved more

Scott McKenzie, a fund manager at Saracen, says that while he believes a cyclical change is happening in the economy, and this means there will be a change in the types of stocks that will perform well in the years to come in contrast to those that have performed best over the past decade, but he says investors will have to be more discerning, as a result of the structural changes in the economy.

He says: “I would be reluctant to invest in the travel and leisure sectors right now, as we just don’t know when they might come back.”

REUTERS/Toby Melville

REUTERS/Toby Melville

Jason Alden/Bloomberg

Jason Alden/Bloomberg

Chris Ratcliffe/Bloomberg

Chris Ratcliffe/Bloomberg

Post-Brexit trade deal: three key takeaways

As 2020 drew to a close, it marked not only an end to a dismal year beset by Covid-19, but also to the UK’s transition period as it ended its membership of the European Union.

There was relief over the festive period among investors that a trade deal had been finalised, helping to boost sterling.

However, the details of the agreement were buried in the 1,500+ page document released on Christmas Day.

The deal was given provisional approval in Europe, where it was felt more time was required to scrutinise it. In the UK, the government pushed the deal through Parliament just a day before the 31 December deadline.

So what will the trade agreement mean for the future of the UK-EU trade relationship?

We have identified three key takeaways that investors should consider.

1. No tariffs and quotas on traded goods, but regulatory barriers have been erected.

Exports in both directions will face customs checks, including the burden to provide proof of origin of the manufacture of goods. Exports will need to continue to meet EU standards and are subject to regulatory checks, not to mention the extra customs formalities which firms will now have to endure. Moreover, trade between Northern Ireland and Great Britain will effectively face additional regulations.

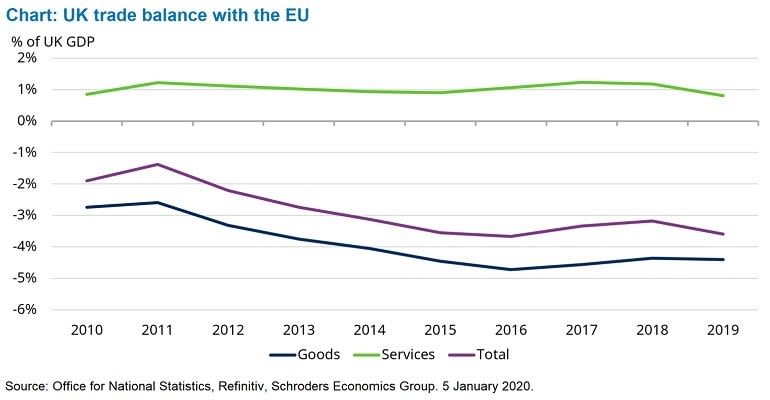

2. No deal for services

While there is a deal on the trade in goods, there is effectively no deal for services. UK companies have lost the right to provide services in many sectors from outside the EU.

National professional qualifications will no longer be recognised with the exception of a few areas.

Crucially, the EU has largely not deemed UK rules for financial services as equivalent. Despite initial calls from financial services businesses for some kind of special arrangements or “enhanced equivalence”, it appears that this was abandoned during talks.

Both sides have agreed to establish “structured regulatory cooperation on financial services”. Among other things, this will cover any future equivalence decisions, with a framework for it to be set out in a “Memorandum of Understanding” to be agreed by March 2021.

The details are sketchy, but what is clear (and had been anticipated for some time by most UK-based financial services businesses) is that they cannot rely on an ability to “passport” from the UK into the EU.

There has been a lot of discussion around delegation of asset management activities from the EU to the UK. It is important to recognise that this does not depend on an equivalence ruling. It requires cooperation arrangements between EU and UK regulators and this is now in place, so such delegation can continue.

3. Tougher rules than other EU trade partners

On the issue of the “level playing field”, the UK will face tougher rules than other EU trade partners (such as Canada and Japan).

The EU or UK can unilaterally impose tariffs on goods if either deem non-compliance; for example, the illegal use of state aid, or loosening of labour or environmental standards.

The good news for the UK is that standards cannot be tightened going forward, and a joint committee will determine if changes need to be made. This removes the risk of non-tariff barriers being snuck in through tighter standards.

Better than no deal

Overall, the deal in place is better than the otherwise default option of moving to World Trade Organisation rules and tariffs. However, the trade agreement is far from ideal, especially for the UK.

Former prime minister Theresa May summed up the situation well, saying: “We have a deal in trade which benefits the EU, but not a deal in services, which would have benefited the UK." (30 December 2020).

Between 2017 and 2019, the UK ran a trade deficit in goods with the EU worth £95.1 billion per annum, compared to a surplus of £22.9 billion from trade in services.

Compared to the assumptions in our forecast, the deal has yielded a slightly better outcome in that there are no apparent restrictions for agricultural products, which we had assumed may be excluded.

Unfortunately, the return to a national lockdown means that our forecast for UK growth is likely to be downgraded at the next review. With the Brexit saga concluded, the government must now focus all of its energy and resources on combating the Covid-19 pandemic.

Azad Zangana is a senior European economist and strategist at Schroders